price to cash flow from assets formula

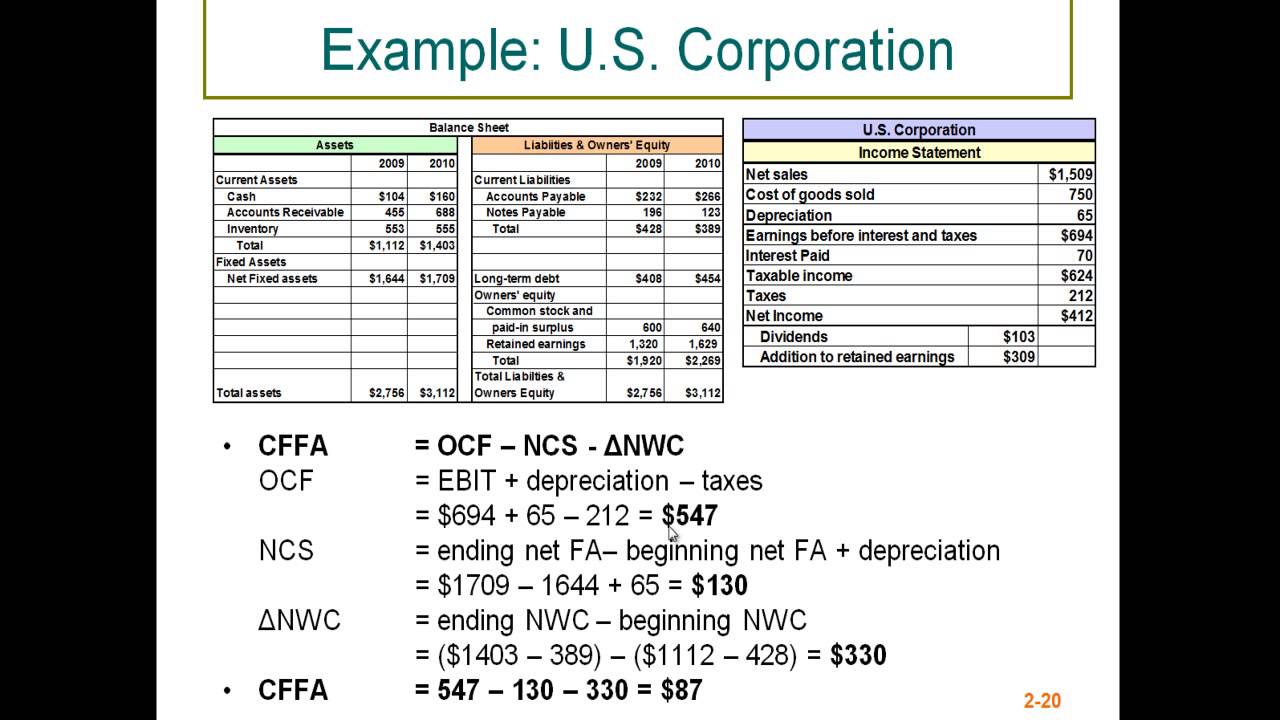

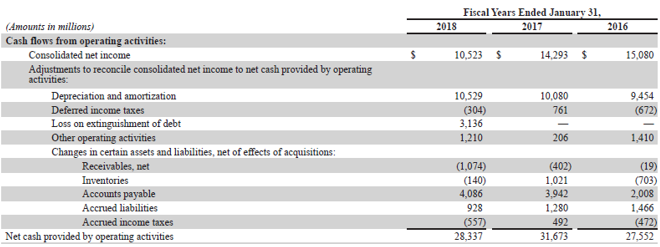

12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in. Cash flow from assets Cash flow to stockholders Cash flow to creditors 146 Cash.

Cash Flow Formula How To Calculate Cash Flow With Examples

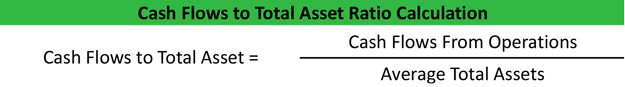

Cash Flow to Assets Cash from Operations Total Assets.

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

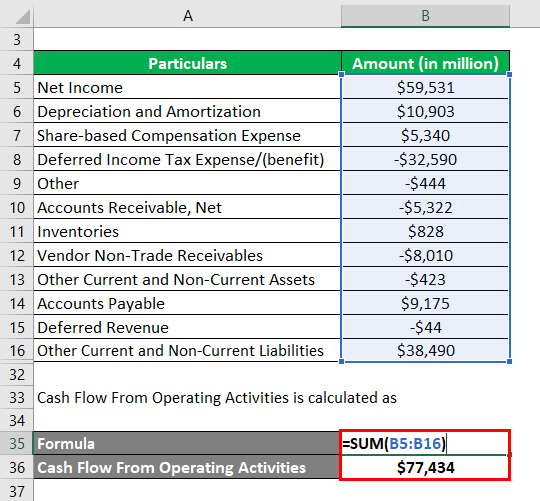

. Rearranging the cash flow from assets equation we can calculate the cash flow to stockholders as. OCF Net Income Depreciation Amortization Change in WC Any other non-cash item Share Price or Market. Operating Cash Flow can be calculated using the following formula.

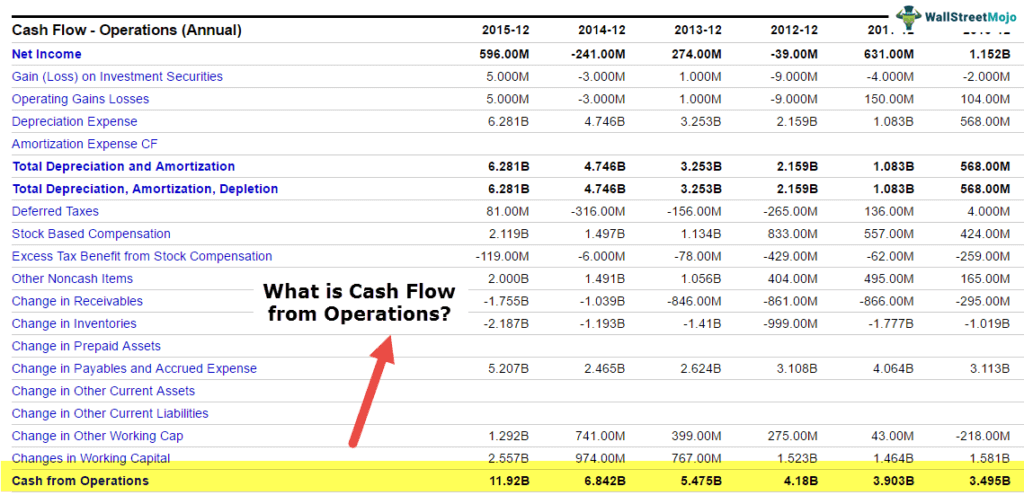

Price to Cash Flow PCF is a valuation metric that measures the value of the company against its operating cash flow per share. The price to cash flow ratio is a pretty straightforward calculation. This ratio indicates the cash a company can generate in relation to its size.

No Technical Skills Required. Firstly figure out the future cash flow which is denoted by CF. Ad Create Edit and Export Any Type of Cash Flow Statement Quickly and Easily.

Price to Cash Flow Share Price Cash Flow per share. The Price - Cash Flow Ratio Formula. If a companys PCF is 20 it means that the.

That means in a typical year Randi generates 66000 in positive cash. The formula for the Price to Cash Flows ratio or PCF is a companys market capitalization divided by its cash flows from operations. This ratio is super useful for investors as they can understand whether the company is over-valued or under-valued by using this ratio.

The formula for the Price to Cash Flows ratio or PCF is a companys market capitalization divided by its cash flows from operations. The formula for present value can be derived by using the following steps. PCF ratio market.

CFFA Method 2 CFCR CFSH CFCR interest paid net new borrowing o CFCR 44679 11412 35001 - 1119823 999244 -29587 CFSH dividends paid net new equity o. Free Cash Flow Net Income Depreciation Change in Working Capital Capex Free Cash Flow 227 million 32 million 65 million 101 million Free Cash Flow 93. 85000 0 9000 -10000 66000.

Randis operating cash flow formula is represented by. The Price - Cash Flow Ratio Formula The PCF ratio is the market price per share divided by the cash flow per share. The price-to-cash flow also denoted as pricecash flow or PCF ratio is a financial multiple that compares a companys market value Market Capitalization Market Capitalization Market Cap.

Next decide the discounting rate. Cash Flows from Operations Net Income Non-cash Items 20 million 5 million 25 million Cash Flow per Share 25 million 5 million 5 per share Price to Cash. Fill Out Business Form Templates W Our Smart Form Software.

Thus if the price to cash flow ratio is 3 then the. The price to cash flow ratio tells the investor the number of rupees that they are paying for every rupee in cash flow that the company earns. The current share price is simply divided by the per-share operating cash flow which is found in the cash flow statement.

The market price per share is simply the stock price. This results in the following cash flow from assets calculation. The numerator market capitalization is the total.

Cash Flow Statement How A Statement Of Cash Flows Works

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Operating Cash Flow Formula Calculation With Examples

Cash Flow Per Share Formula Example How To Calculate

What Is Cash Flow On Total Assets Ratio Definition Meaning Example

Fcf Formula Formula For Free Cash Flow Examples And Guide

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Net Cash Flow Formula Calculator Examples With Excel Template

Price To Cash Flow Ratio Formula Example Calculation Analysis

Price To Cash Flow Ratio P Cf Formula And Calculation

Cash Flow From Operations Formula Example How To Calculate

Cash Flow Formula How To Calculate Cash Flow With Examples

Disposal Of Assets Disposal Of Assets Accountingcoach

Net Cash Flow Formula Calculator Examples With Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples